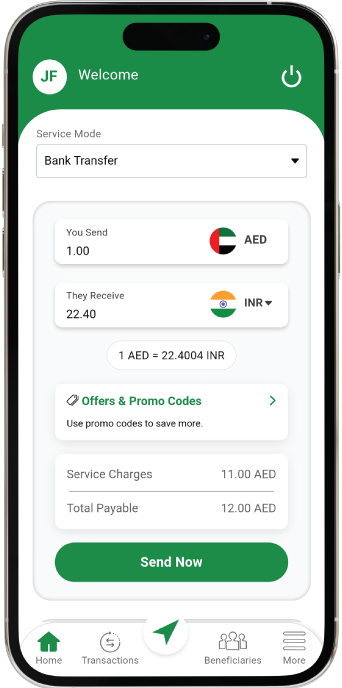

Money Exchange, Money Transfer Services

UAE

Fiji

Seychelles

Singapore

Hong Kong

United Kingdom

info@gccexchange.com

info@gccexchange.com 600 522 049

600 522 049